arizona charitable tax credit fund

Due to the COVID-19 outbreak the deadline for filing and paying State and Federal income tax has been extended from April 15th 2020 until July 15th 2020. If you solicit under another name and have documents authorizing your solicitation of contributions under that name a copy of such authorization.

![]()

Qualified Charitable Organizations Az Tax Credit Funds

Credit eligible donations from January 1 through April 15 of a calendar year may be used as a tax credit on the prior years tax return.

. The Funds ability to utilize various tax-managed techniques may be curtailed or eliminated in the future by tax legislation or regulation. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayers own dependent.

Interest on federally exempt US. However the deadline for Arizonans to make charitable contributions and qualify for state income tax credit remains April 15th. Maximize your deductions and save time with various imports reports.

For example qualifying donations made January 1 2021 to April 15 2021 may be used as a tax credit on either your 2020 or 2021 Arizona income tax return. Obligations Enter the amount of interest or dividends exempt from federal income tax but taxable in Virginia less related expenses. The Funds exposure to derivatives involves risks different from or possibly greater than the risks associated with investing directly in securities and other investments.

An individual may claim a credit for making contributions or paying fees to an Arizona Public or Charter school. 23 is a United States federal law that imposes a federal employer tax used to help fund state workforce agencies. A school tuition organization cannot award restrict or reserve scholarships solely on the basis of a donors recommendation.

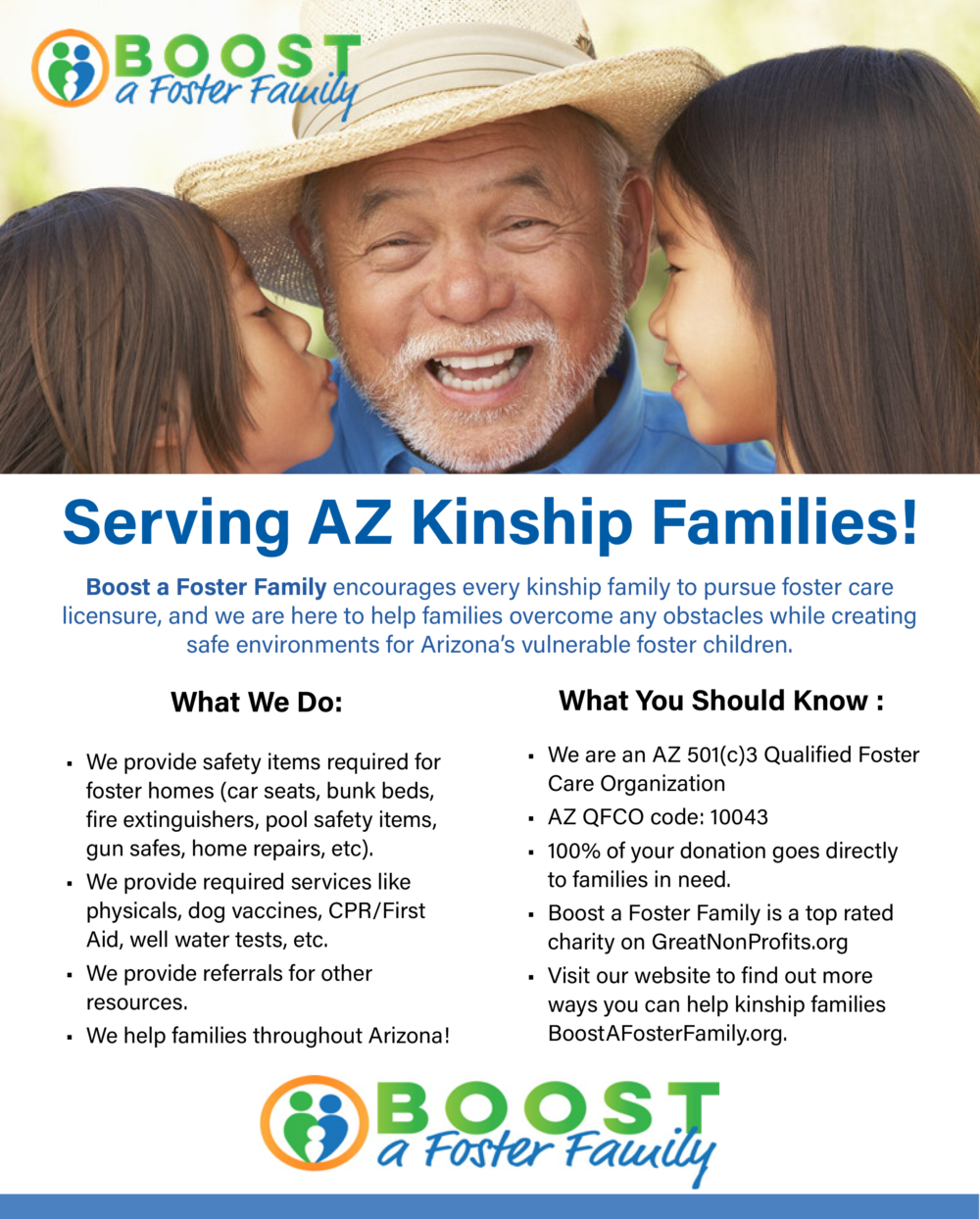

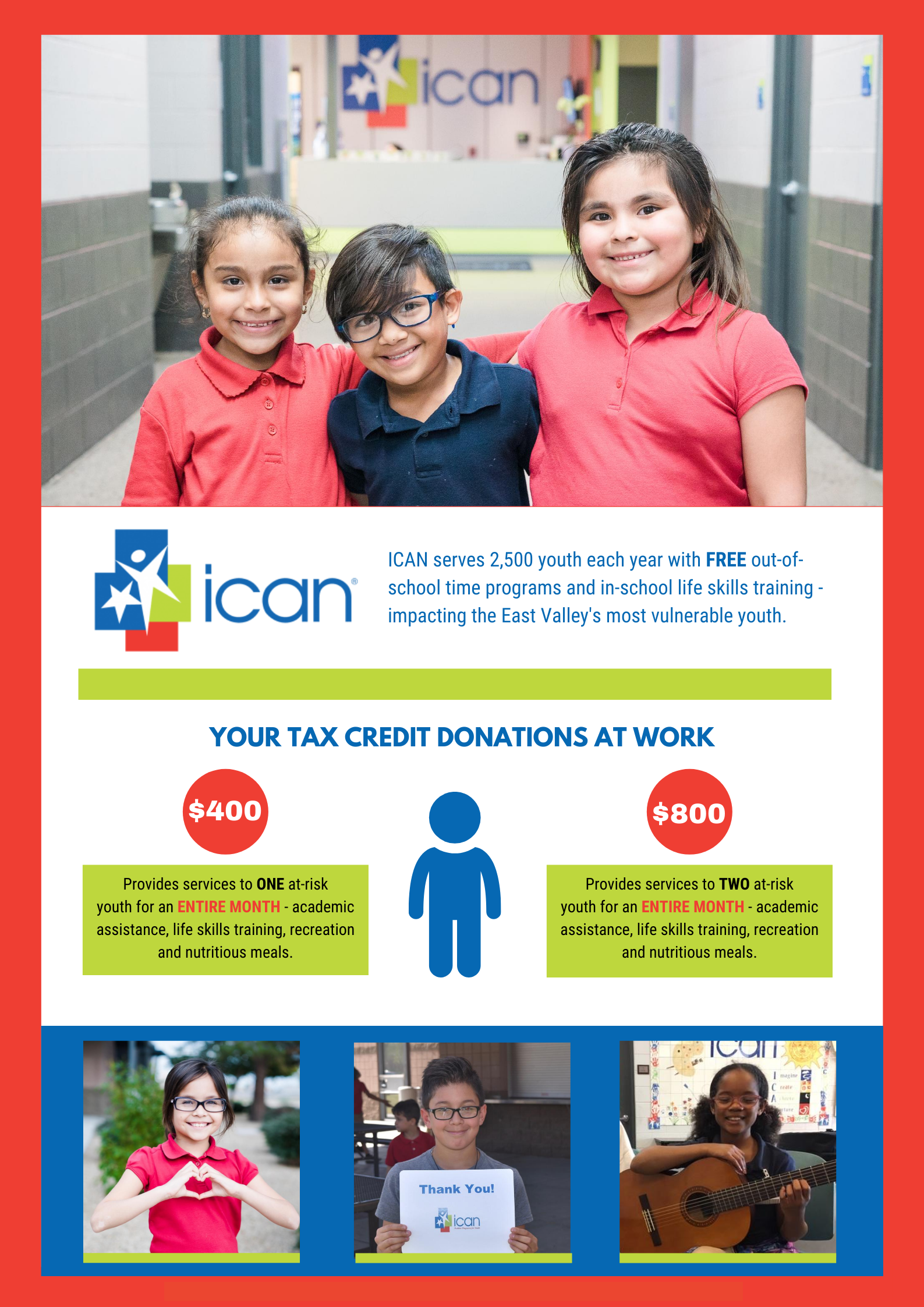

Your dollar-for-dollar tax credit donation to a Qualified Charitable Organization will support organizations assisting low income children individuals and families. Fund accounting refers to the management and allocation of revenue an organization acquires through donations tax payments grants and other public and private sources. See below for additional information.

Arizonas private education tax credit empowers individuals and corporations to choose what their tax dollars support and greatly impact Catholic schools. The Federal Unemployment Tax Act or FUTA IRC. Bills memorials and resolutions are measures enacted or under consideration by the Legislature.

Maximum statelocal tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of March 2021. The basic idea behind fund accounting is to monitor and document the use of assets that are donated by outside parties. Rather than writing a check to the state of Arizona you can be one of many to direct your tax credits to the General Fund serving schools with highest need or the schools of your choice.

Arizona has a state income tax that ranges between 259 and 45 which is administered by the Arizona Department of RevenueTaxFormFinder provides printable PDF copies of 96 current Arizona income tax forms. According to a 2021 report from the Pew Charitable Trusts Arizona has funding for only 652 of its pension liabilities less than all but a. The Fund has adopted a policy to pay common shareholders a stable monthly distribution and may pay distributions consisting of amounts characterized for federal income tax purposes as qualified and non-qualified ordinary dividends capital gains distributions and non-dividend distributions also known as return of capital.

TaxAct C Corp tax preparation software is designed to identify a broad range of business expenses and derive maximum tax savings when filing 1120 tax form. A copy of any amendments to the charter bylaws or other. Employers report this tax by filing an annual Form 940 with the Internal Revenue Service.

Accumulation distribution income Enter the taxable income used to compute the partial tax on an accumulated distribution as reported on federal Form 4970. 109 95 State Additional Bundle with 1040 Software Benefits Forms Requirements 100 Accuracy Guarantee Rest assured TaxAct guarantees the calculations on your return are 100 correct. Charitable tax benefit is reduced at higher contributor income levels or subject to a cap.

Make your tax credit donations from one easy-to-use site. Easy Guidance Tools for Partnership Multi-Member LLC Tax Returns. An audited financial statement if the organization grossed more than 500000 in revenue excluding grants from governments agencies and 501c3 private foundations.

Start The Process Az Tax Credit Funds

Arizona Charitable Tax Credit Donations St Mary S Food Bank

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Foster Care Charitable Organization Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

Arizona Charitable Tax Credit Can Benefit Hcc

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

List Of 6 Arizona Tax Credits Christian Family Care

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Get Az Tax Credits When You Donate To St Mary S Food Bank

Cdt Kids Charity Arizona Tax Credit

Arizona Charitable Tax Credit List 2020

Arizona Charitable Tax Credit List 2020

Tax Credit Charitable Giving For Free Fsl

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Childrens Hospital Foundation